Cost-Effective

Simple solutions quickly available at your fingertips. Apply with just one document

Simple solutions quickly available at your fingertips. Apply with just one document

Trust us as your direct lender with a modern approach! Your data stays safe, and we support you in tough times

Simple solutions from home, fast. Instant money in your account and flexible loan terms

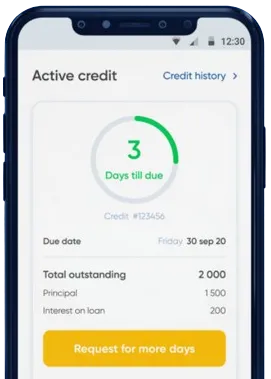

Apply through the app by completing the necessary form.

Wait for our quick decision, which takes only 15 minutes.

Accept your funds, normally transferred in about one minute.

Apply through the app by completing the necessary form.

Download loan app

Payday loans have become a popular financial tool for many individuals in South Africa who find themselves in need of quick cash. These short-term loans offer a variety of benefits that make them a useful option for those facing unexpected expenses or financial emergencies.

One of the key advantages of payday loans in South Africa is the quick and convenient application process. Unlike traditional bank loans, which can take weeks to process, payday loans can often be approved and disbursed within a matter of hours. This makes them an ideal option for those who need money urgently.

Additionally, payday loan providers in South Africa typically have minimal documentation requirements, making the application process simple and straightforward. This means that individuals can access the funds they need without having to provide extensive financial documentation.

Another benefit of payday loans in South Africa is their flexibility and accessibility. These loans are available to a wide range of individuals, including those with less-than-perfect credit histories. This makes them a viable option for those who may not qualify for traditional bank loans.

Furthermore, payday loans can be used for a variety of purposes, from covering unexpected medical expenses to paying for car repairs. This flexibility allows individuals to use the funds as needed, without any restrictions on how the money is spent.

Additionally, payday loan providers in South Africa typically offer online applications, making it even easier for individuals to access the funds they need from the comfort of their own homes.

Payday loans in South Africa are subject to regulations that govern the lending industry, including rules around interest rates and fees. This means that borrowers can be confident that they are entering into a fair and transparent agreement when taking out a payday loan.

Payday loans in South Africa typically come with flexible repayment options, allowing borrowers to choose a repayment schedule that works for them. This can include weekly, bi-weekly, or monthly payments, depending on the individual's financial situation.

Additionally, many payday loan providers in South Africa offer the option to repay the loan early without incurring any penalties. This can help individuals save money on interest and pay off their loan more quickly, providing them with greater financial flexibility.

Payday loans in South Africa offer a variety of benefits that make them a useful financial tool for individuals facing unexpected expenses or financial emergencies. With their fast and convenient application process, flexibility, and transparent terms and conditions, payday loans can provide individuals with the financial support they need when they need it most.

A payday loan is a short-term loan that is typically repaid on the borrower's next payday. It is designed to provide quick access to funds for individuals who need immediate financial assistance.

In South Africa, individuals can apply for a payday loan online or in person at a lending institution. The borrower must provide proof of income, identification, and bank details. Once approved, the funds are usually deposited into the borrower's bank account within a few hours.

To qualify for a payday loan in South Africa, individuals must be employed, have a valid South African ID, have a bank account, and be over the age of 18. Lenders may also require proof of income or employment.

The fees and interest rates for payday loans in South Africa can vary depending on the lender. Typically, lenders charge a fixed fee per R100 borrowed and interest rates can range from 20% to 30% per month.

If you are unable to repay your payday loan on time in South Africa, you may face additional fees, interest, and penalties from the lender. It is important to contact the lender as soon as possible to discuss alternative repayment options.

Payday loans can be a useful financial solution for individuals who need quick access to funds in emergency situations. However, they should be used responsibly and only for short-term financial needs. Borrowers should also consider the fees and interest rates associated with payday loans before taking out a loan.